ALBERT, INTEREST, AND YOUR LIFE YIELD, PART 1

My first principal was a sage man who, after hiring me, encouraged me to max out my 401k from the start. He said, if I never had the money to begin with, I would never miss it and I would retire a rich man.

Being an educated and relatively financially savvy person, I immediately followed his advice. Being a drummer, I only followed part of it. I did not max out the contribution, and I regret it to this day.

Dumb move!

What's the difference between worry-free retirement and pinching pennies? The answer is simple, compounding interest.

Thought to have originated in 17th-century Italy, compound interest can be thought of as "interest on interest." It will make a sum grow faster than simple interest, which is calculated only on the principal amount.

Albert Einstein is credited as stating that compound interest is the world's eighth wonder, and while the recent volatility of the market has me nervous, Albert assures me that if I stay the course, in the long run, I will be 401 OK!

Compounding interest teaches us that the key to amassing wealth is not TIMING the market (buy-low, sell-high), but TIME IN the market. In other words, start early, start small, and stay long.

I have always understood what compounding interest was, but it wasn't until I was in my forties did I fully realize the immenseness of it and impact it could have in my life and retirement.

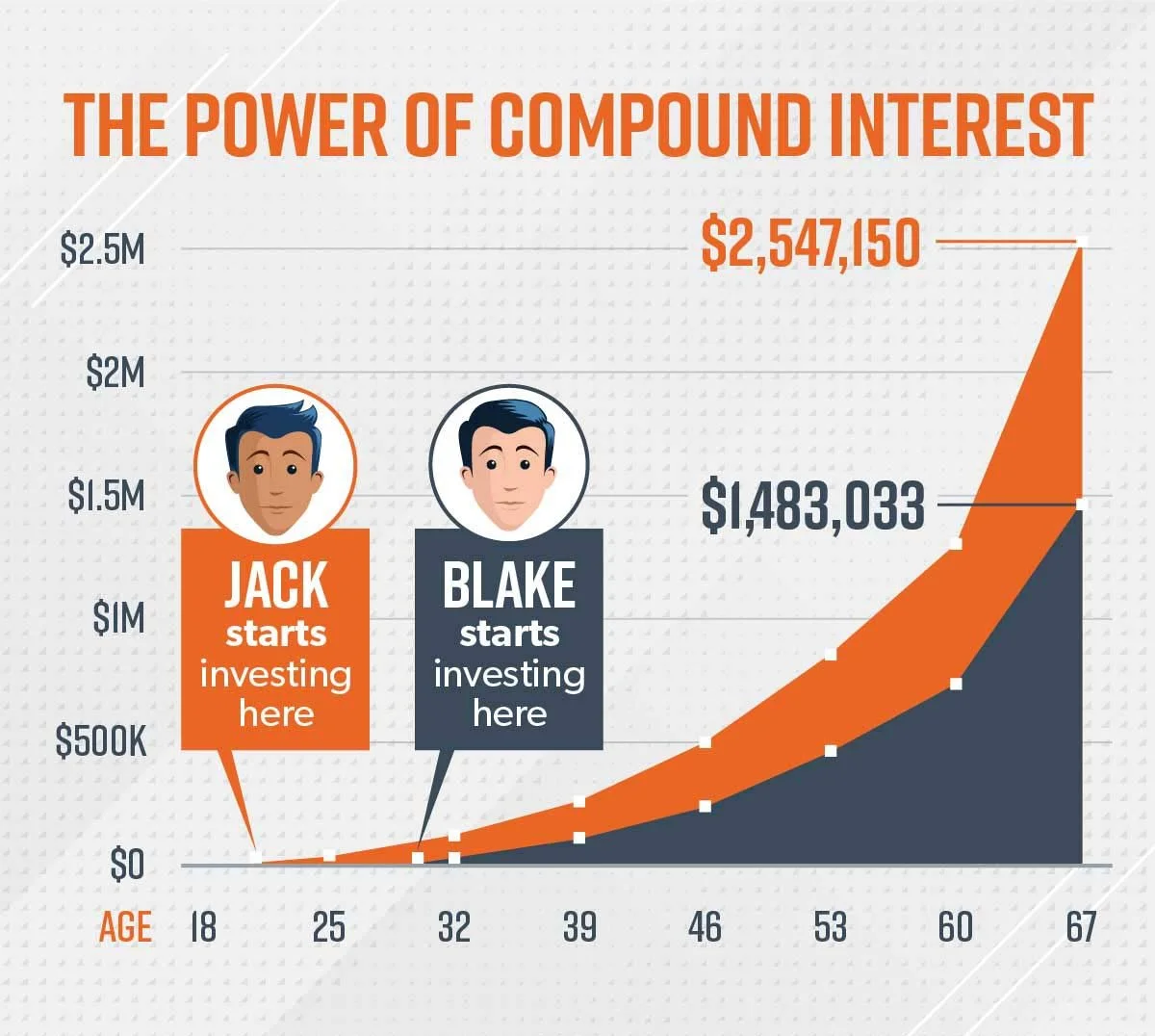

To help you see the power of compounding interest in action, here's the story of Jack and Blake —two guys who got serious about investing for retirement. They picked good, growth stock mutual funds that average an annual return of about 11.6%—just under the long-term growth rate of the S&P 500.

graphic and example courtesy of Ramsey Publications

Jack

Starts investing at age 21

Invests $2,400 every year

Stops contributing money at age 30

Total amount contributed: $21,600

Blake

Starts investing at age 30

Invests $2,400 every year

Contributes money until age 67 (a total of 37 years!)

Total amount contributed: $91,200

At age 67, Jack’s investment has grown to $2,547,150, and Blake’s has grown to $1,483,033! Nine years made a difference of over one million dollars.

How does a $21,000 investment become worth $2.6 million while an investment of five times more yields 44% less money? COMPOUNDING INTEREST!

Properly invested, money traditionally doubles every seven years. By waiting an additional seven years, Arthur misses one and a half cycles of his money doubling, which is trivial at age 36, but is significant at retirement age.

The true yield from investing doesn't come from the amount you invest, but the length of time you allow it to grow. Again, start early, invest small, and stay long.

See your earning potential between now and your retirement. It's both fun and scary.

I did not know this when I was 21. I could have spared $2,000 a year (and enjoyed the tax benefit) from my first decade of teaching. I had no kids, no wife, and not much of a social life. Let's be real, I was working all the time, didn't buy expensive things and had a roommate to share rent and expenses with.

I could have been Jack. Heck, I could have been more than Jack. But, back then I didn't know jack about being like Jack!

Dumb!

I wish I had been more forward-thinking. I wish I had planned better. I wish I understood that my actions at twenty-three would have would have a significant impact not just in my life, but in my wife and children's as well.

DUMB!

Einstein was right when he said compounding interest is the world's eighth wonder. And, it's as true for you as it is for your students, but not in the way you might think. Curious about how? I will explain tomorrow. Why?

Because I want to let your interest compound overnight (see what I did there).

Until then, have a great Wednesday!

-Scott